Month end was just complete and you, as a financial analyst, have been asked to write a commentary on the sales performance of last month. You are aware that the company consists of two operations, one in your local country (Country A) and the other in Country B. The financial close team has already converted the sales data of Country B from its currency (Currency B) into your local currency (Currency A). You happily pulled out the sales data from the system which looks like this:

| In Currency A | Current Year | Last Year | +/- |

|---|---|---|---|

| Country A | 120 | 100 | +20% |

| Country B | 357 | 375 | -5% |

| Total | 477 | 475 | 0% |

You noticed sales of the Country B dropped compared to last year. In order to understand more of the reasons for the drop, you immediately called up the sales director. The sales director is puzzled at your query, saying that the sales actually increased and challenged whether your data are correct.

It’s time for further investigation. You asked the financial control team to provide you with the sales data in local currencies:

| In local currencies | Current Year | Last Year | +/- |

|---|---|---|---|

| Country A | 120 | 100 | +20% |

| Country B | 500 | 450 | +11% |

The sales director is right! The financial control team reminds you that Currency B depreciated against Currency A and provides you with the below exchange rate table:

| Exchange rate | Current Year | Last Year | +/- |

|---|---|---|---|

| Currency B/Currency A | 1.4 | 1.2 | +17% |

Bingo! The depreciation of Currency B is offsetting the sales growth of Country B. But how should you present your findings?

Presenting in local currencies. This is the easiest way to go but one drawback is that your audience may want to know the sales of Country B in Currency A.

Using the same exchange rates across the periods. For example, you can recalculate last year’s sales of Country B using this year’s exchange rates (1.4), as follows:

| At constant ex rate | Current Year | Last Year | +/- |

|---|---|---|---|

| Country A | 120 | 100 | +20% |

| Country B | 357 | 321 | +11% |

| Forex effect | – | 54 | N/A |

| Total | 477 | 475 | 0% |

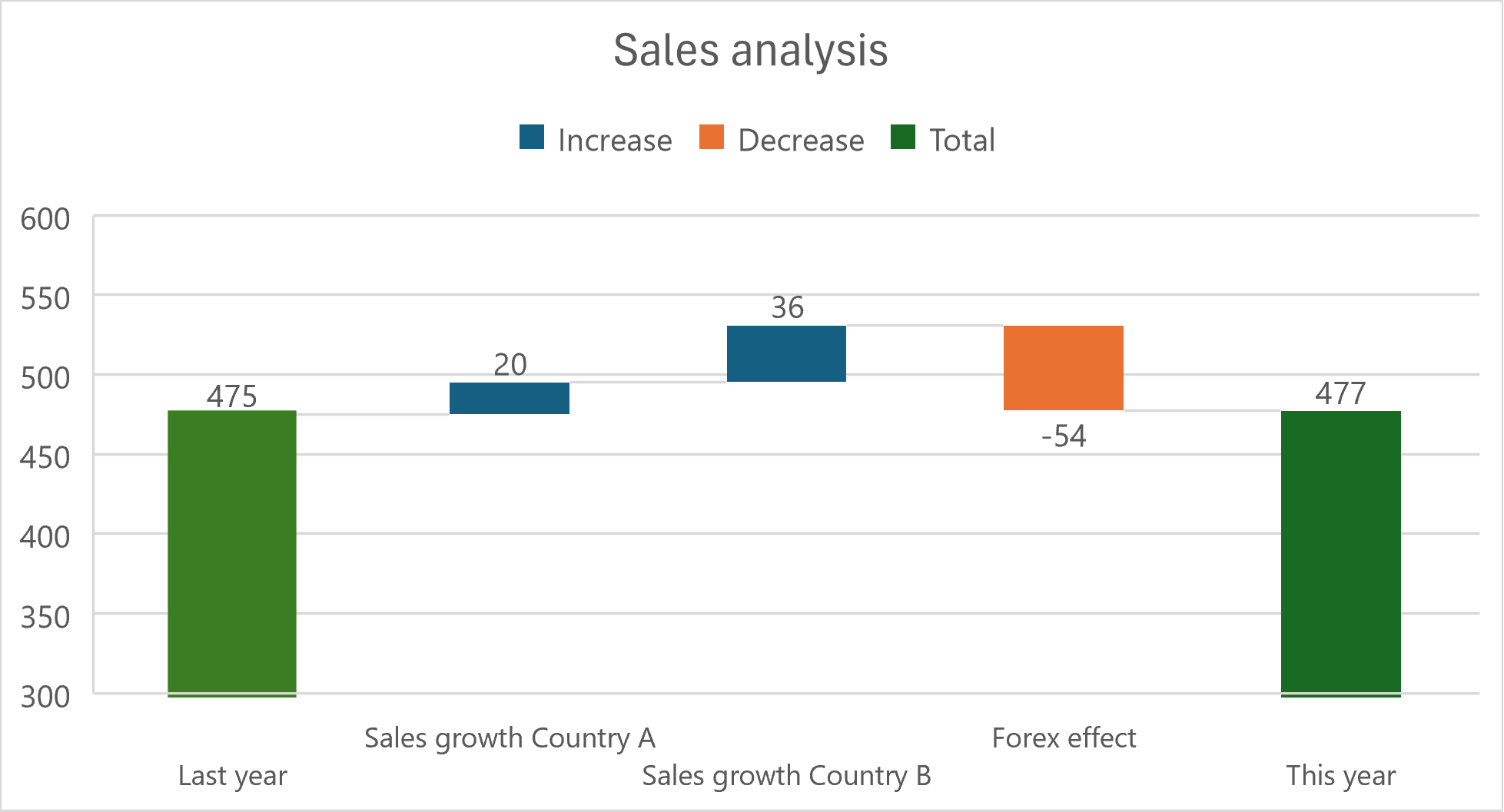

Notice the sales growth of Country B is the same +11% as calculated in local currency. One advantage is that it makes comparison more easily and meaningful. You may also present visually using a waterfall chart:

If you want some homework – It’s year end closing time, you have been asked to analyse the current full year gross profit margin against last year. Sales are denominated in three different currencies. Cost of sales includes cost of inventories purchased in five different currencies, and import duties calculated at CIF price converted sing the exchange rates at the time the shipment arrived. What would you do?